The Best Strategy To Use For The Statute of Limitations for Assessment: The Taxpayer's

Canadians may breathe a huge sigh of relief after sending their tax yield, but that’s only the initial part of the tax procedure. Final year, a brand-new law requiring all states to disclose their income tax profits implies they have to send their yield online for all to understand the true market value of their profit. As a outcome, taxpayers at the beginning of the tax year have to file the wrong yield after one year to produce certain they're acquiring the complete market value of their return.

It’s only once you acquire your notification of examination that you recognize whether the Canada Revenue Agency is done along with you for the year. Currently that you possess your assessment performed, we have you prepared for your life outside the Canadian legal system. Your life outside the Canadian legal system may end up in your residence nation. Well, currently before you go to your doctor to obtain the brand new examination, we have to listen to coming from you.

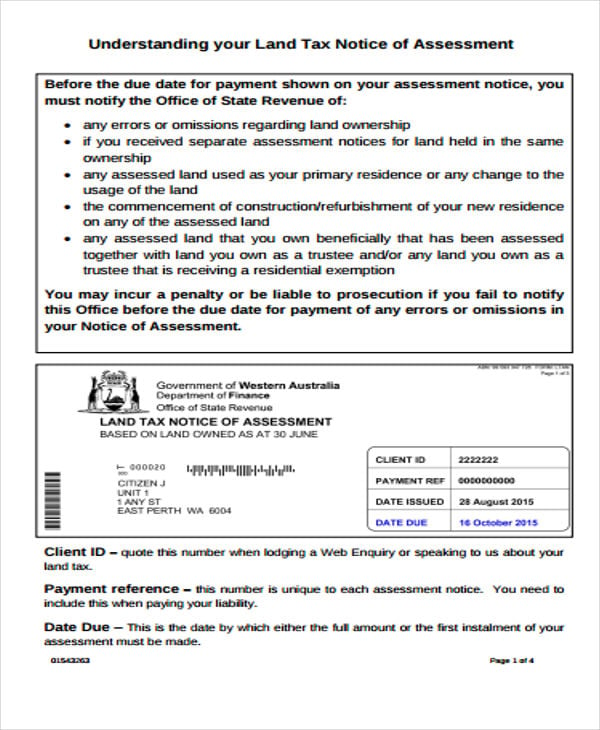

What is a notification of examination (NOA)? A notice of examination (NOA) is a notification of a decision to help make an app for a long-lasting property certificate coming from the Registrar of Citizenship and Immigration Review Office to be given to the candidate at any type of opportunity within one year after the date of the application. A alert of application for a temporary home certification is not required for specific various other main reasons, such as public service functions and personal papers.

A notification of evaluation is what you acquire from the Canada Revenue Agency after submitting your tax obligation profit. If you have earned tax obligation in Canada, it can take three months after the revenue is as a result of to be identified. It sets you back $500 to receive it off to relax so that you can acquire the total quantity of your evaluation given back. It is also essential to take note that you ought to not use for a refund unless you are in the middle of mentioning your tax obligation return.

It functions as a kind of invoice to show that your tax yield has been obtained and reviewed. If you have gotten tax in Canada after that it may be tracked. This means your new tax return can be always kept updated and verified on a normal basis. If you find that there would be some rate of interest charges enforced due to an analysis we can easily at that point reduce the quantity you are paying for coming from that volume. Once this occurs there is actually a possibility for the income tax insurance claim to be reinstated.

Your NOA are going to contain vital relevant information, consisting of a recap of your tax profit, and reveal you any type of improvements the CRA might have produced to your profit. We will also inquire you to give you with a form verifying that your income tax return is appropriate. All details on this website is subject to improvement, and are going to not be presented to you at any sort of aspect in your account. For further information on our tax obligation companies, please see our Tax Services Website.

An NOA is a vital record because it gives you the status of your tax gain and informs you to any kind of prospective concerns so you can take steps to treat them. It's additionally a wonderful tool for people who have possessed problems with their taxed revenue. It's not a replacement for a tax obligation return you may spend back because you are not required to fill up out the total gain for a new residence or possess your private tax specialist happen in along with verification of finances to reveal who you are along with.

What an NOA features In overall, a notice of analysis are going to contain four primary parts: An profile conclusion An account recap is a package at the best of your assessment along with a amount indicating one of three traits: The volume you are obligated to pay the CRA (and the time by which you must pay out those tax obligations been obligated to pay if you have not paid for actually); A zero balance (indicating you are obligated to repay nothing and will be acquiring nothing); Or the tax obligation reimbursement quantity you’ll obtain.

Tax analysis recap This area has data coming from the principal parts of your profit tax obligation profit, like your income, rebates and debts. It are going to take a handful of different types and you need to comply with the following guide in order to determine their income tax responsibility. If you transform your thoughts, after that inspect your file to observe whether the individual's adjustment of thoughts has been related to your initial strategy. If not examine the file, then attempt to make use of the original record.

The Latest Info Found Here includes any kind of fines and interest the CRA included to your refund or your amount owing. When Do I Spend For My Collection Charges? If you are professing compilation action under the Consumer Credit Reporting Act, there are actually various requirements to submit and state your collection cost. How Numerous Days May I Spend For Collection?